Travel cards offer many different perks to add value to cardholders of all types. Nowadays, it is common for most premium travel cards to offer some sort of travel credit. Some of these credits can be very simple to use and include wide-ranging travel costs while others can be much more specific.

One of the more difficult travel credits to use effectively is the airline fee credit offered by American Express on the following cards:

- The Platinum Card ($200)

- The Business Platinum Card ($200)

- The Gold Card ($100)

- Hilton Honors Aspire Card ($250)

In theory, this credit sounds good – you can avoid various fees that airlines seem to hit you with every step of the way. However, there are only specific fees that the credit can be applied to and if you intend to get your full value out of your card and justify the annual fee, you need to know what works and what doesn’t.

What’s Covered By The Credit

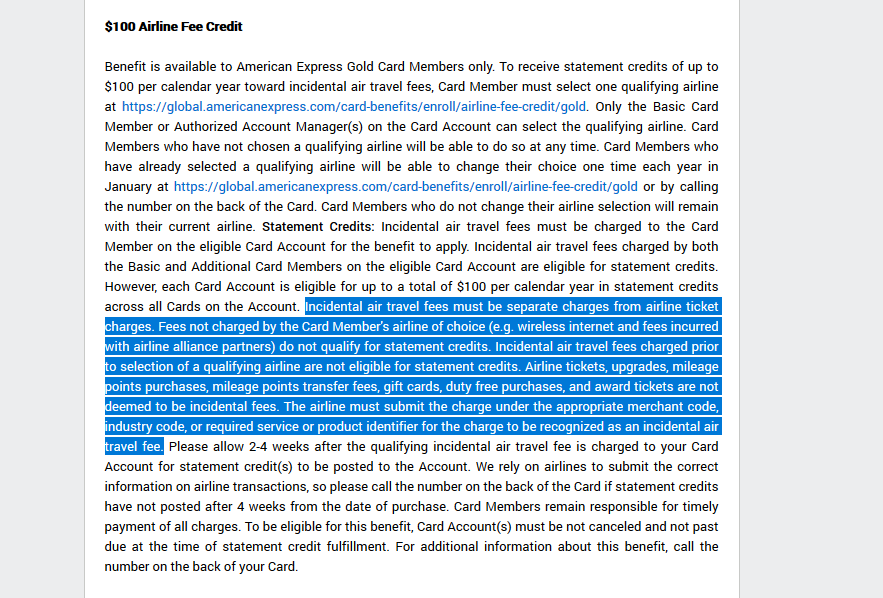

Since the airline fee credit is meant to apply exclusively to “fees”, there are a lot of charges that won’t be covered. Here’s the official language from the Amex website on what items are covered and what’s not:

Now, while that may sound pretty definitive, there are a lot of reports (including my own personal experience) that would indicate these rules aren’t always hard and fast. For example, there are multiple times that I’ve had seat upgrades or inexpensive flight fares get credited back.

To better help you understand what is likely to be covered or not, I’ve broken the following list into two categories: always and sometimes. Please use this list as necessary while keeping in mind that the “sometimes” category can change at any time.

Always

The following charges are always covered:

- Lounge Passes

- Baggage Fees

- Change Fees

- Inflight Food and Drinks

- Seat Selection fees

- Priority Boarding Fees

Sometimes

The following charges are often covered despite not being “officially” in line with Amex’s terms:

- Delta gift card add-on (if you use a gift card for part of your airfare purchase and your credit card for the remaining balance)

- United Airlines seat upgrades after original purchase

- American Airlines seat upgrades after original purchase

One important point to note is that you should always pay for the charge you intend to get reimbursed for in a separate transaction from the airfare purchase. This is important, because you want the charge to get recognized by Amex correctly and not lumped into the airfare purchase.

For example, pay your checked bag or seat selection fee after booking your ticket, not during the booking process. While you can always call Amex and see if you can get the charge manually approved, it can be an additional headache you can avoid – especially if it’s not a charge clearly approved in the terms.

However, don’t go charging any of these to your card without first selecting the airline you’d like to receive this benefit through.

Selecting Your Airline

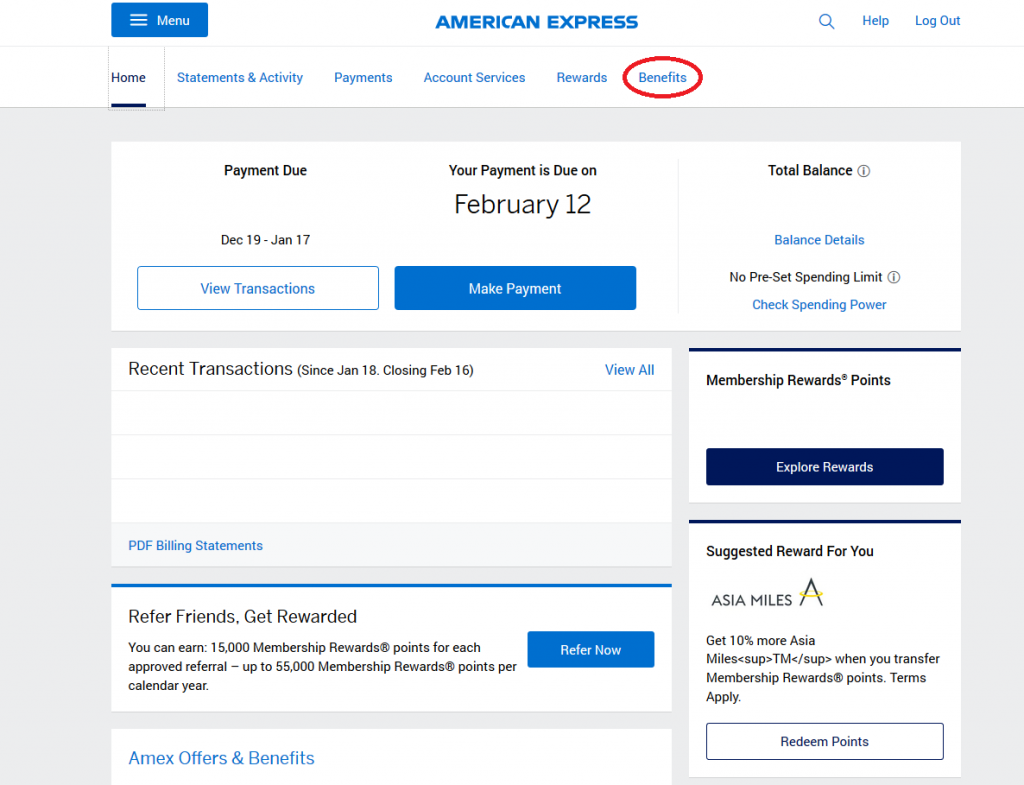

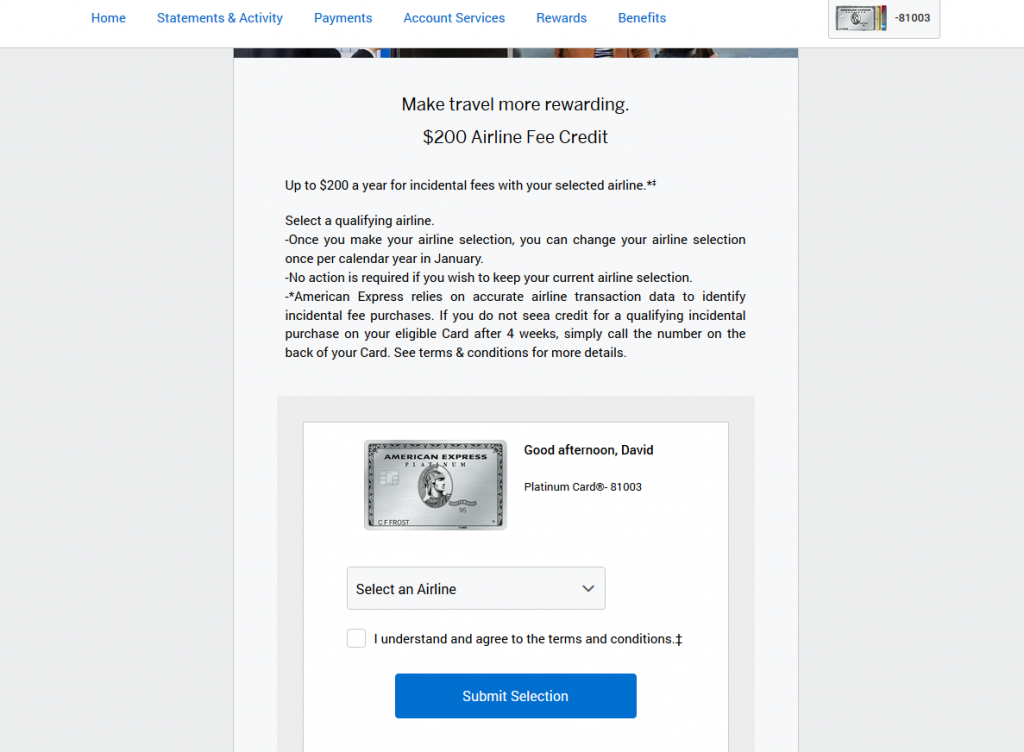

The Amex airline fee credit isn’t automatic and won’t apply to all airlines. So, before you intend to charge any fees to your card, you’ll need to login to your online account and select your chosen airline from the benefits dashboard.

When you have arrived at the home screen, you’ll need to navigate to the card benefits dashboard. This can be done by clicking the “Benefits” link in the navigation menu at the top right portion of the screen.

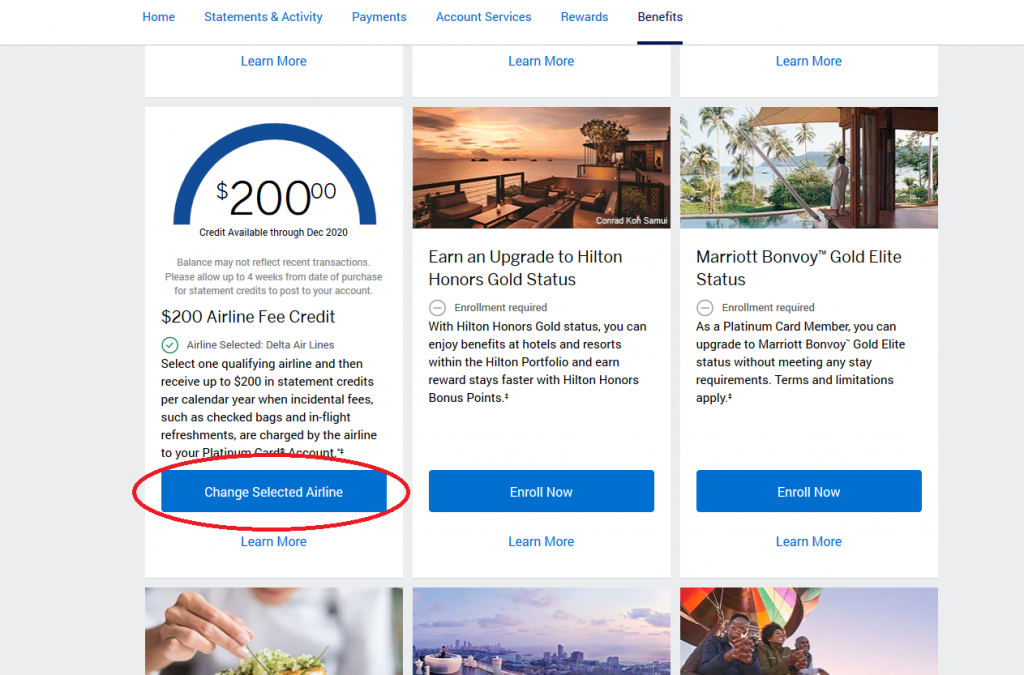

Next, scroll down to the area where you’ll see how much of your annual credit is still available and simply click the blue button that reads “change selected airline.”

Next click on the drop-down box to choose the airline you’d like.

The following airlines can be selected for your yearly American Express airline credit:

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

Perhaps you don’t fly any of the airlines above or fly multiple and don’t know which one you should choose, that’s ok. Below I’ll cover the most common strategies that you can employ to ensure you don’t waste your credit and make it easier to choose correctly.

Best Strategies For Using Your Airline Fee Credit

It can be challenging to select just one airline for an entire year, especially if you don’t have any travel plans set just yet. The good news is, as long as you haven’t used any of your credit, you can call Amex and switch your choice up to 1 time per year (in addition to your original choice). Before you make your choice, consider the three strategies below and if one of them makes the most sense for your situation.

Strategy #1 – Winning With Spirit or Frontier

If you are the type of traveler that often looks for the cheapest flight or prefers to fly these two ultra-low cost carriers (ULCC), then choosing one of these airlines may be ideal. Since both airlines charge extra for everything from sodas to seat selections, you can use up your Amex credit quite quickly. This will keep your flight costs low and even allow you to sit in better seats like Spirit Airline’s “big front seats” for free. Essentially you’ll be able to get standard airline benefits for low cost carrier pricing.

Strategy #2 – Getting Status Like Perks On Your Favorite Airline

If you’re the type of traveler that prefers a specific airline or lives near a hub for a particular airline, but you don’t travel enough to have status on that airline, then the choice may be easy. You’ll be able to rack up plenty of fees via food, drink, checked bags, and maybe even seat upgrades to enhance your experience. That means you’ll feel like you have status without all the flying. If you value comfort and convenience over all else, this is probably your pick.

Strategy #3 – Diversify Your Options

If you live in a city that has you often taking different airlines to reach your destination or you’re just a frequent traveler with no loyalty, then this could be right up your alley. Perhaps you have multiple trips already planned or you have a couple Amex cards where you can pick 2 or more airlines. If so, it can pay to diversify your credits across multiple airlines. By selecting an airline (or airlines) that you don’t use often, you can save yourself the hassle of being hit with checked bag fees or cancellation/change fees which often carry the highest costs. I have personally implemented this strategy in the last year and found it to be of huge benefit since I travel quite a bit and can’t always predict when I may need to deal with various fees.

Conclusion

When acquiring cards with substantial annual fees, it’s critical to make sure you are able to monetize all the benefits the card comes with. The Amex airline fee credit can be one of the more benefits to maximize, but with the right strategy in place and a little knowledge on your side, you can easily make it worth your while.