I want to talk to you about credit cards. Specifically, I want to help you answer the question of which travel credit card might be best for YOU.

There are so many options out there and often it can be hard to not only tell one from the other, but also which one might be the best fit for your lifestyle and spending habits. Between annual fees, sign-up bonuses, point earning rates, travel credits, and airport lounge access, the benefits can be overwhelming.

So, today, I’m going to help you understand these perks and compare the top 6 travel cards currently on the market so you can choose the card that will help you meet your travel goals as quickly as possible.

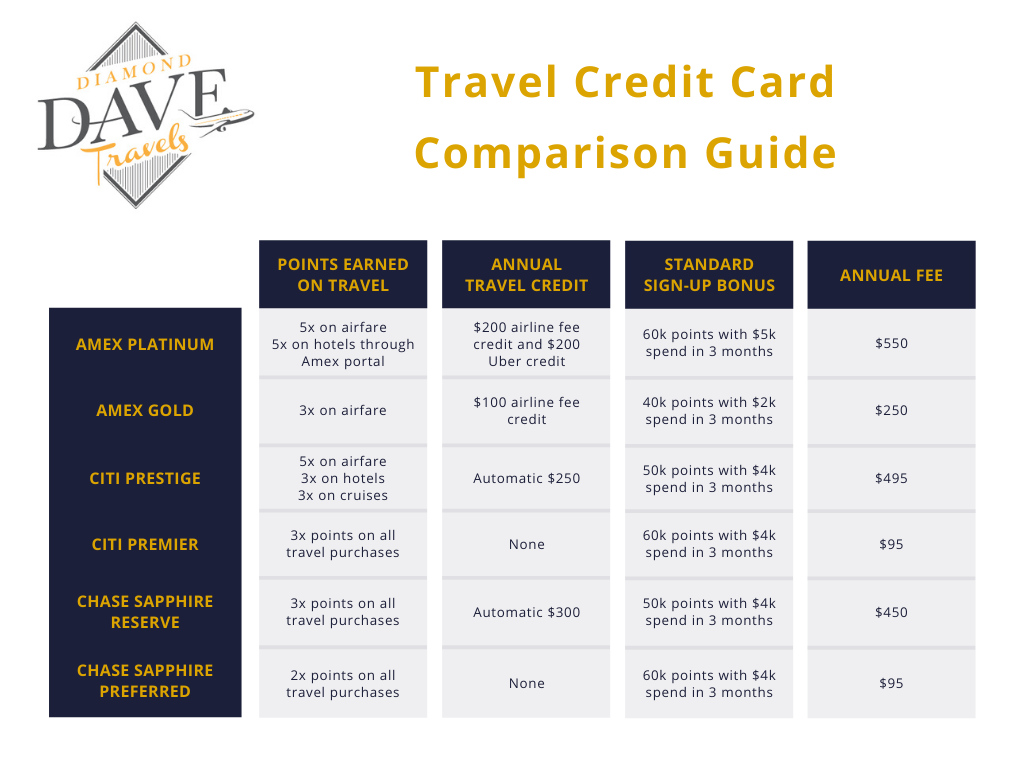

Here’s a quick chart to get you acquainted with cards we’ll be looking at:

And now for a quick rundown of the benefits you can expect from some of these cards:

- Sign Up Bonus – The amount of points you’ll be given when you open a card and spend the required amount of money in the designated amount of time.

- Annual Travel Credit – These can vary. An automatic credit will be automatically applied to any travel purchase on the card until the full credit amount is spent. An airline or hotel fee credit only applies to fees charged to the card from that particular hotel chain or airline.

- Point Earning on Travel – Most travel credit cards offer an enhanced point earning opportunity on travel purchases. Instead of earning 1 point per dollar, you’ll earn anywhere from 2-5 points per dollar instead which will help you earn points faster.

- Airport Lounge Access – While not listed in the above table, some travel cards offer the ability to access certain airport lounges. This benefit is great for those that prefer to have a comfortable place to relax before or in between flights that include free food and drinks.

Obviously, there are a lot of options to consider and preferences vary from person to person. With that in mind, I’ve provided you with recommendations to match you with the right card quickly.

Here are the winners:

Best “All-Around” Travel Card

The Chase Sapphire Reserve is the winner here. It has solid point earning power on dining and travel purchases, airport lounge access with a free priority pass membership, a free TSA Precheck/Global Entry credit, decent sign-up bonus, and even though the annual fee is $450, you get an automatic $300 back in travel credit. That means any user can get at least twice as much value out of this card as the annual fee.

Runner Up For Best “All-Around” Travel Card

The Citi Prestige Card is kind of like the dark horse. While not nearly as popular as some of the other cards on the list, it packs some great value. With good point earning multipliers on airfare and other travel categories, an automatic $250 travel credit, and Priority Pass lounge access, this card stacks up quite close to the Chase Sapphire Reserve (CSR). However, there is one advantage over the CSR – twice a year you can book a 3-night hotel stay and get the 4th night free at participating properties. This is especially valuable for those that like to stay in high-end properties.

Best Card For Delta Flyers or Airport Lounge Access

The American Express Platinum Card takes this one. The opportunity to earn 5x points on travel purchases creates a lot of potential, and despite the $550 annual fee, the 60k points sign-up bonus is one of the highest. Additionally, this card offers airport lounge access to the Priority Pass network, American Express lounge network, and all Delta SkyClubs (when flying Delta). That means it’s almost guaranteed that you’ll be able to find a lounge in any airport. The final benefit that others lack is that this card also offers complimentary gold status at Hilton and Marriott branded hotels which includes valuable perks such as upgraded rooms and free breakfast.

Best Low Annual Fee Travel Card

While high annual fees are common in the travel points game, some people prefer to get fewer perks in order to have a low annual fee. For those travelers, the card that’s the clear winner is the Citi Premier Card which only has an annual fee of $95. Even though this card won’t offer lounge access, you still get a great 60k point sign-up bonus and earn 3x points on all travel including gas stations.

Conclusion

All the cards featured in this comparison earn transferrable points, which are the most valuable variety and give you the most options when booking travel. Regardless which one you choose, by applying and spending on your respective card you’ll be on your way to booking free travel.