The American Express Platinum card is one of the longest-running and most iconic travel cards on the market. Since its introduction, it has been one of the most aspirational cards for those that want a host of benefits to make traveling much more comfortable and convenient.

Despite sporting an annual fee of $550, the Platinum card is loaded with perks that make it easily justifiable for many users. Some of the well-known benefits that you’ll get for that price tag are unmatched lounge access, upgraded status at multiple hotel chains, travel and shopping credits, and even discounted international airline tickets through American Express’ own International Airline Program.

While many of these benefits are applied automatically, such as earning 5x points on flights or Delta Sky Club access, others require enrollment or registration if you wish to utilize them. In today’s post, we’ll be covering the 6 things that you need to do immediately upon receiving your Platinum card so you can extract maximum benefit and easily justify that $550 annual fee.

The Benefit Dashboard

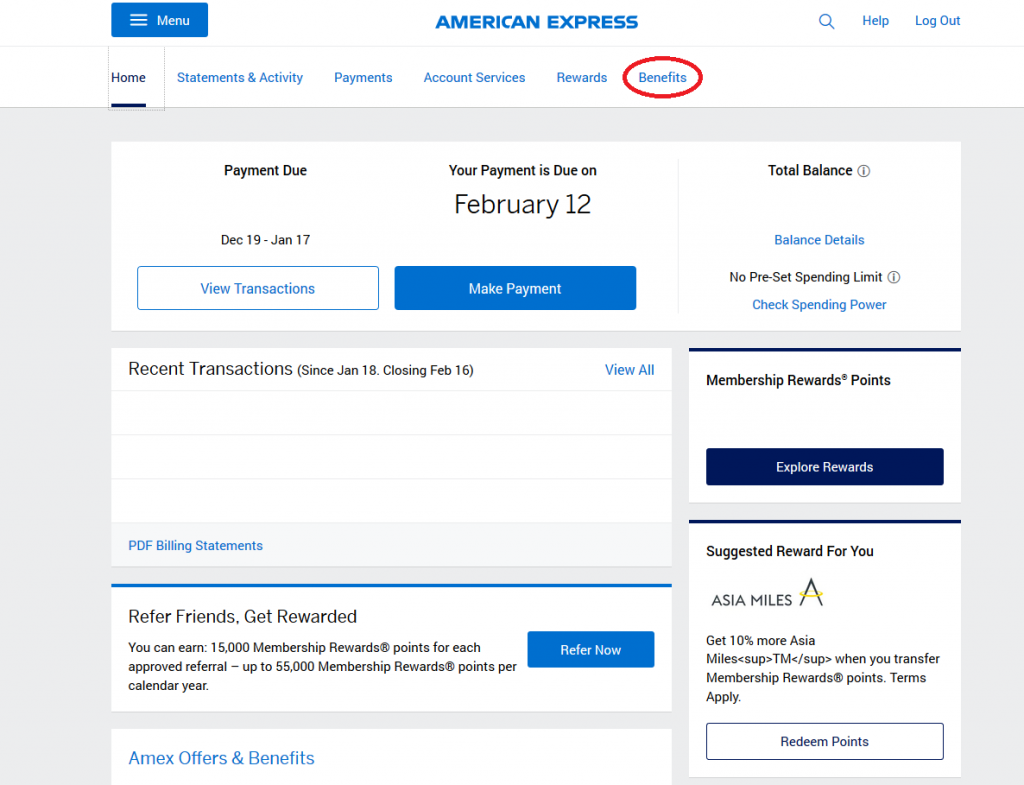

In order to access and enroll in any of the additional benefits of your Platinum card, you’ll need to create an online account to manage all things credit card related. Once that’s done, you should log into your account where you’ll be directed to the home screen as seen below.

When you have arrived at the home screen, you’ll need to navigate to the card benefits dashboard. This can be done by clicking the “Benefits” link in the navigation menu at the top right portion of the screen.

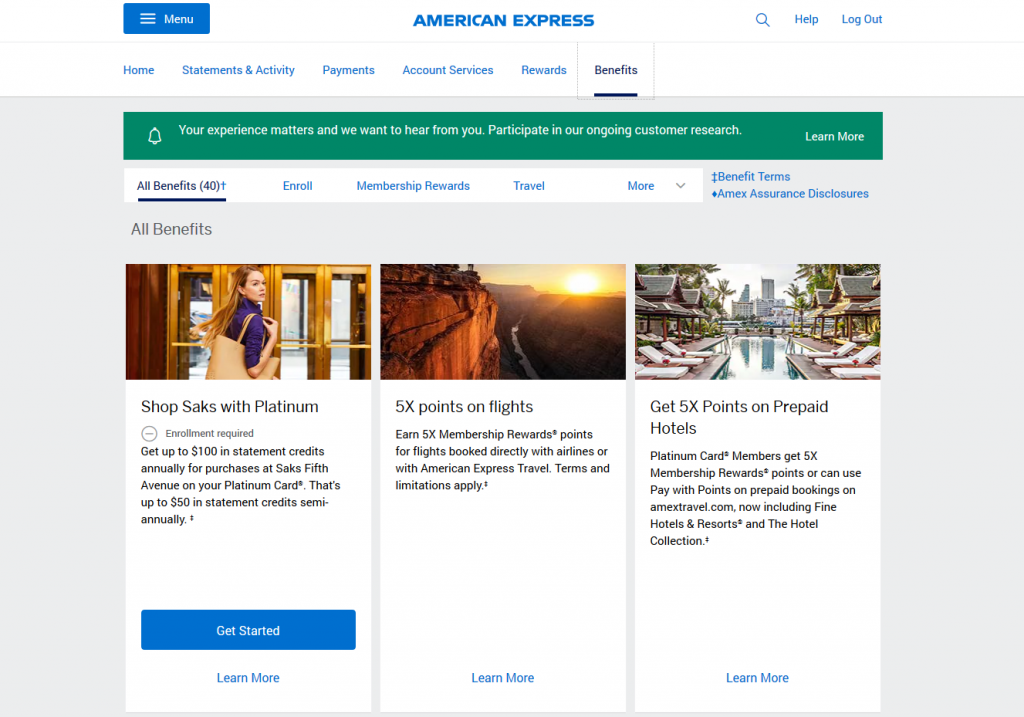

Upon reaching the benefits dashboard, you’ll now be able to complete the following 6 items that will get all your important benefits setup so you can maximize your new Platinum card.

Must-Do Item #1 – Enroll In Priority Pass

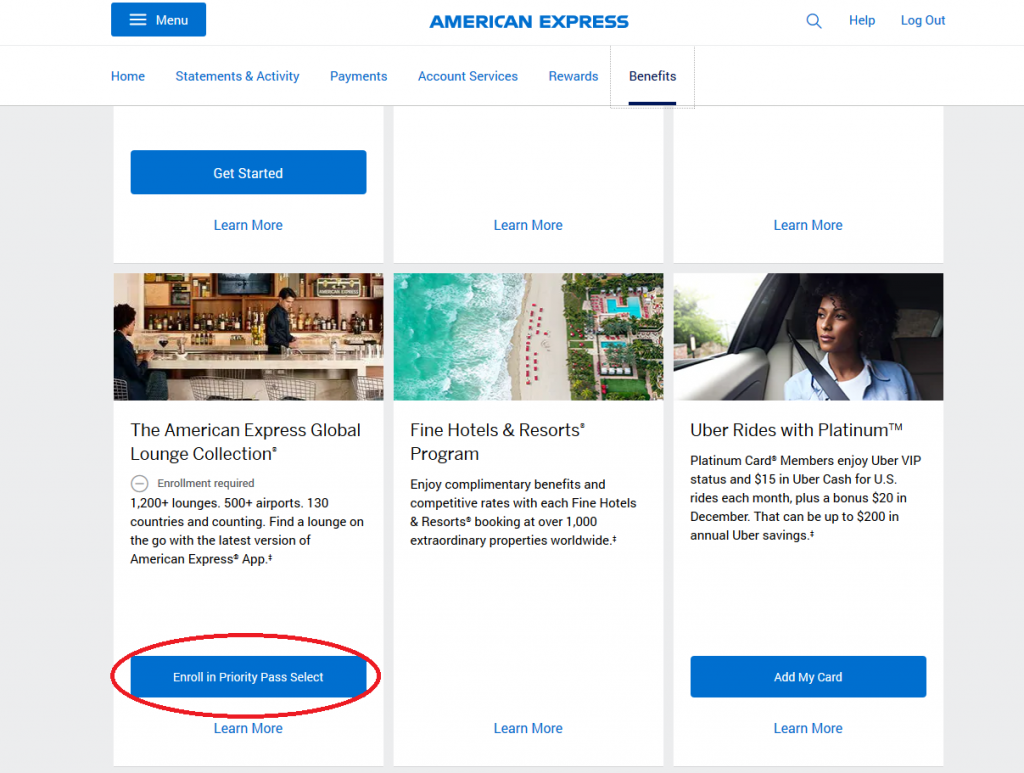

Priority Pass is a company that partners with over 1300 airport lounges all over the world to offer access to passengers traveling. The average Priority Pass yearly membership costs about $200, but Platinum cardholders receive access for free. Between accessibility to PP lounges, Delta Sky Clubs, and Amex Centurion lounges, Platinum cardholders are likely to find a lounge to relax in at almost any airport.

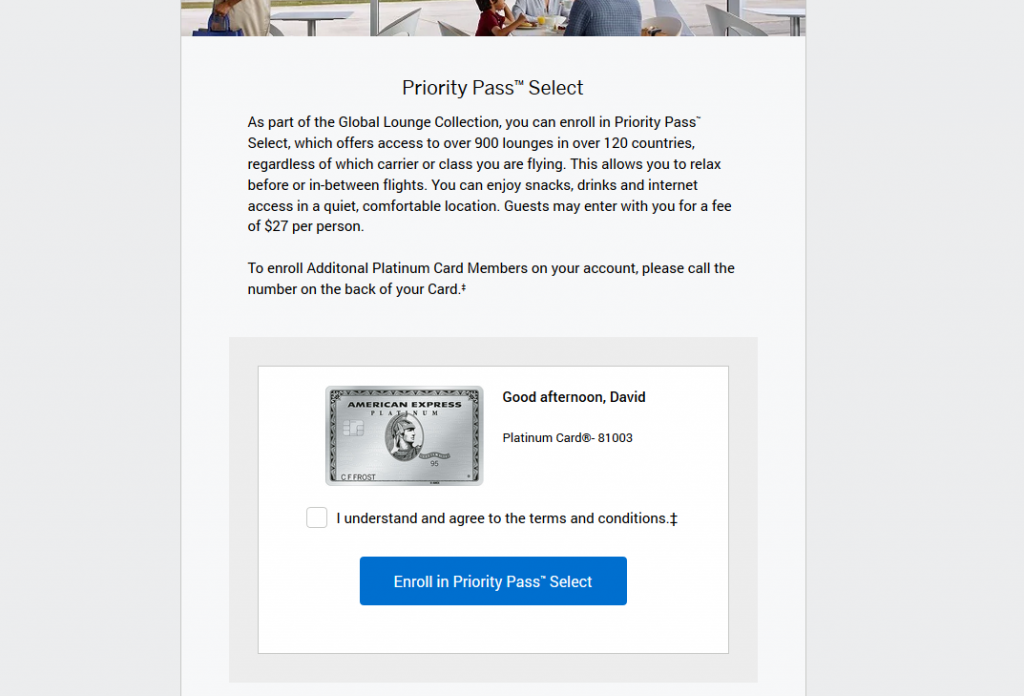

To enroll in the Priority Pass program after reaching the benefits dashboard, you’ll simply need to scroll down and find the Priority Pass tile and click the blue button titled “enroll in priority pass select.”

Then click the checkbox to agree to the terms and click the blue button to enroll.

Must-Do Item #2 – Register To Receive Uber Credits

Every year Platinum cardholders are able to receive up to $200 worth of Uber credits. Each month American Express will deposit $15 worth of Uber cash in your account for you to take rides (except for December, which credits at $20). While the credit doesn’t rollover from month-to-month if you don’t use it, this is still a great benefit if you take Uber rides even sporadically.

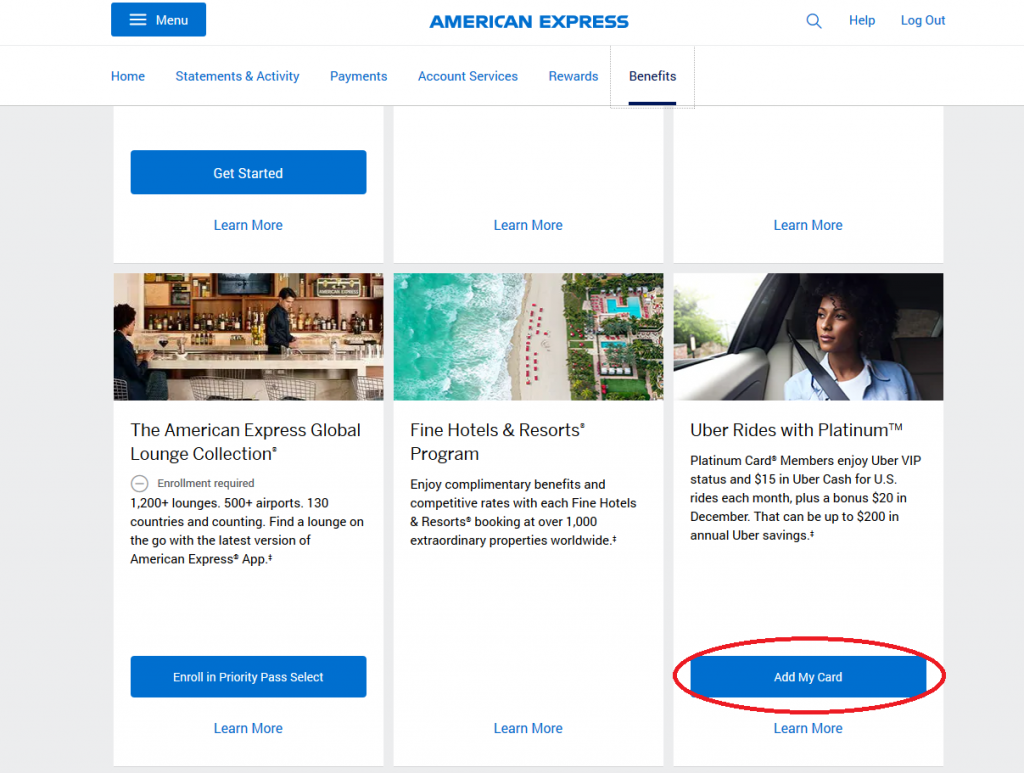

To register to receive your Uber credits, go to the benefits dashboard and you’ll simply need to scroll down and find the Uber tile and click the blue button titled “add my card.”

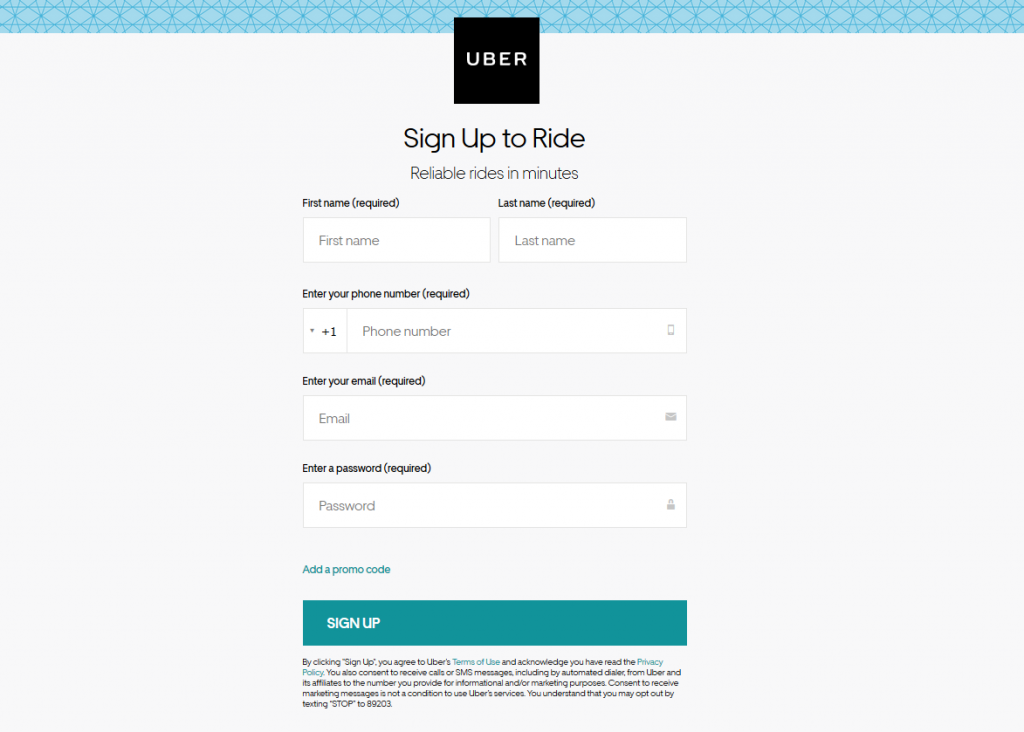

Next, enter your Uber account info so Amex knows where to send your credit each month. If you don’t have an Uber account, you’ll need to set that up first before proceeding.

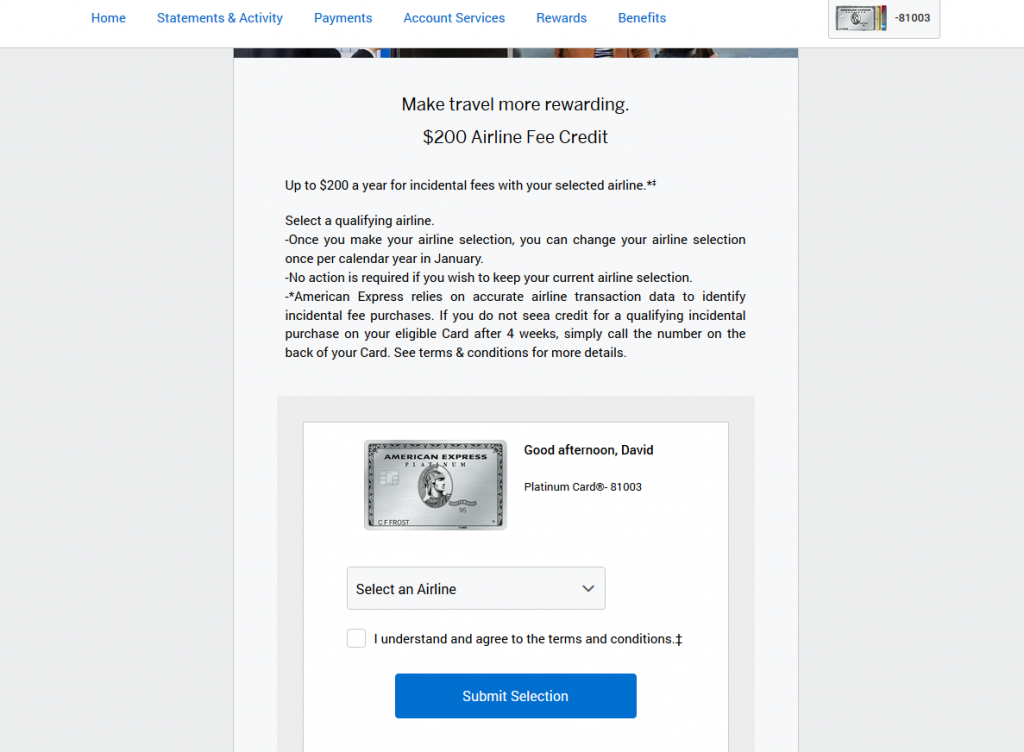

Must-Do Item #3 – Select Your Preferred Airline

Airline fees can be a slow killer – a bag charge here, seat upgrade fee there. It always seems like you’re getting nickel and dimed. Fortunately, the Amex Platinum card comes with a $200/year airline fee credit. However, in order to use the credit, you must first select the airline that you would like to use it on. This is necessary so that Amex knows which charges should be credited back after you’re charged.

Keep in mind that after your initial airline choice, you’ll only be able to change to another airline once per year in January. With that in mind, I recommend choosing an airline that you don’t already have a co-branded credit card or status with.

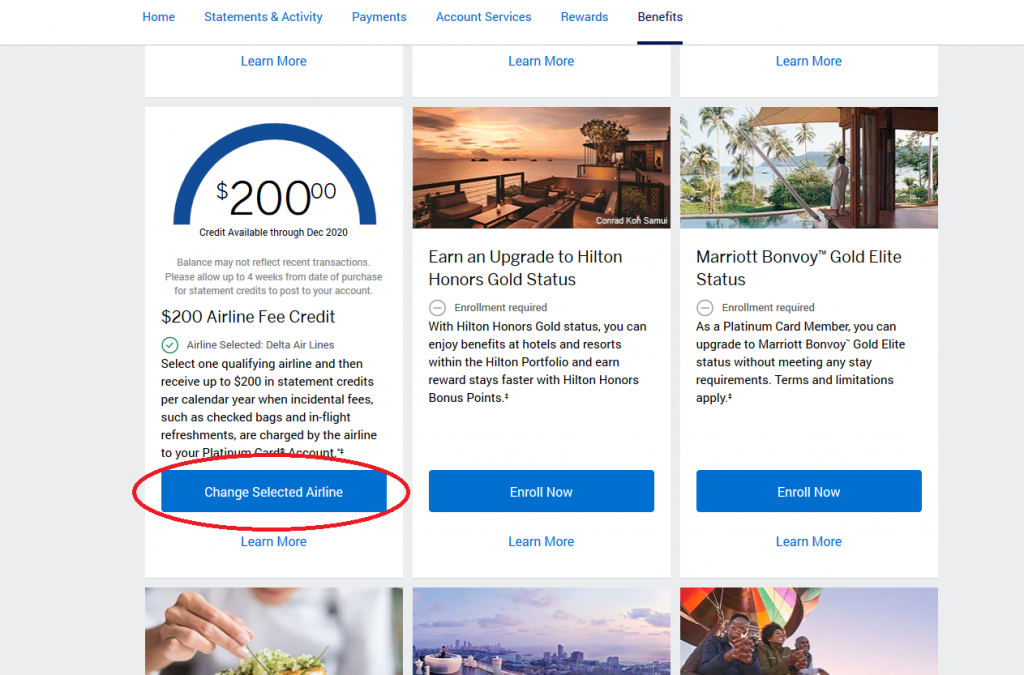

Choosing your airline is pretty simple. Navigate to the benefits dashboard and scroll down to the area where you’ll see how much of your annual credit is still available and simply click the blue button that reads “change selected airline.”

Next click on the drop-down box to choose the airline you’d like.

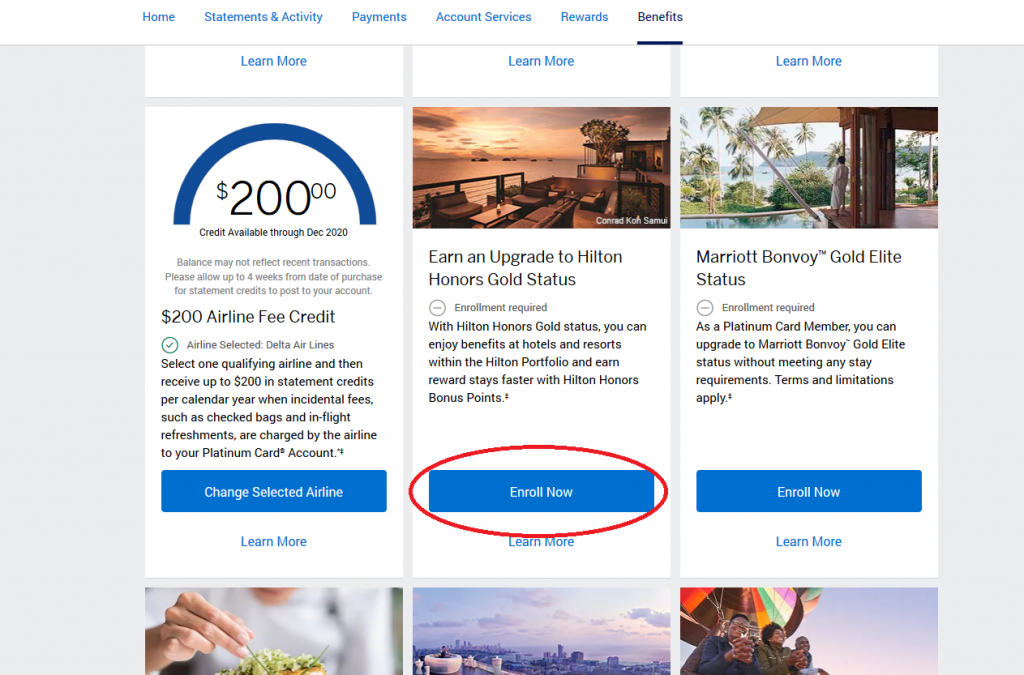

Must-Do Item #4 – Upgrade To Hilton Honors Gold Status

Whether or not you make it a priority to stay at Hilton hotel properties, you might want to start consider it when you are traveling. That’s because Platinum cardholders can apply to receive immediate Hilton Honors Gold status. This level of status includes benefits such as:

- Complimentary breakfast for two

- Room upgrades (if available)

- Late check-out

- Earning 80% more points on each stay

- Executive Lounge Access (if upgraded to an executive level room)

- A free 5th night when booking a cash/point stay for 4 consecutive nights

Those benefits can really make a difference and add up to hundreds of dollars of value even if you just complete a couple stays per year.

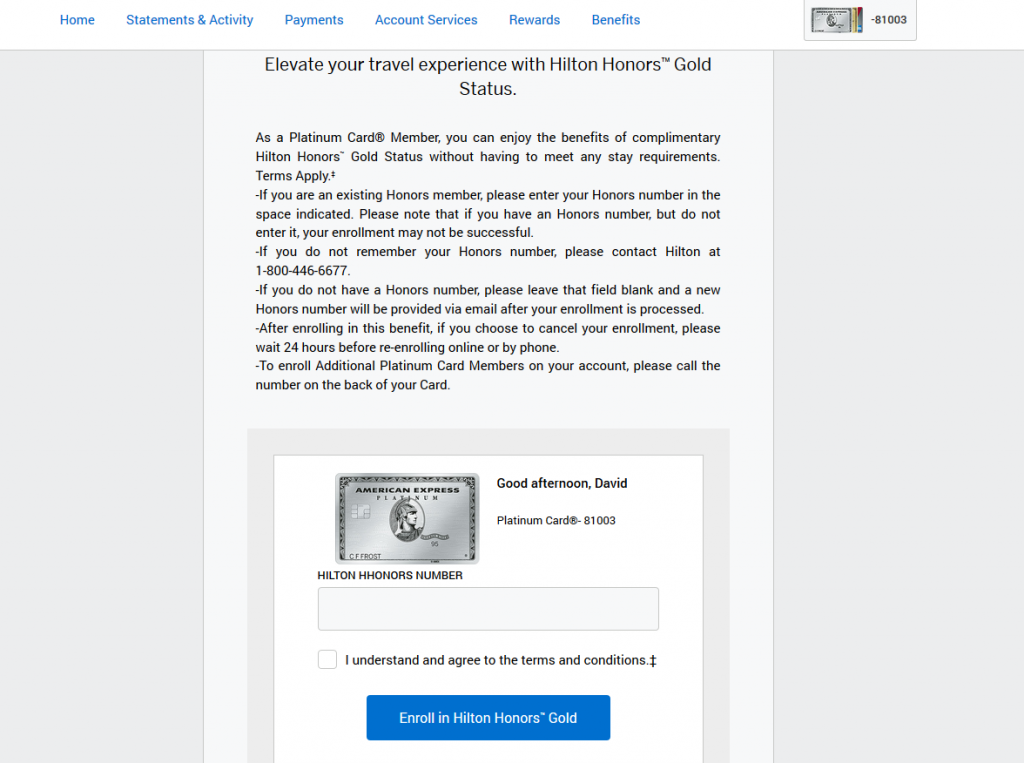

To get your Hilton Gold status, you’ll first need to sign up for a free Hilton Honors account here.

After you do that and have your Honors account number, sign into your online Amex account and navigate to the benefits dashboard using the steps at the top of this article. Then, scroll down until you find the Hilton tile and click on the blue button labeled “Enroll now.”

After clicking that button, you’ll be redirected to a page where you’ll enter your Hilton Honors account number and finalize the process by clicking “Enroll in Hilton Honors Gold.”

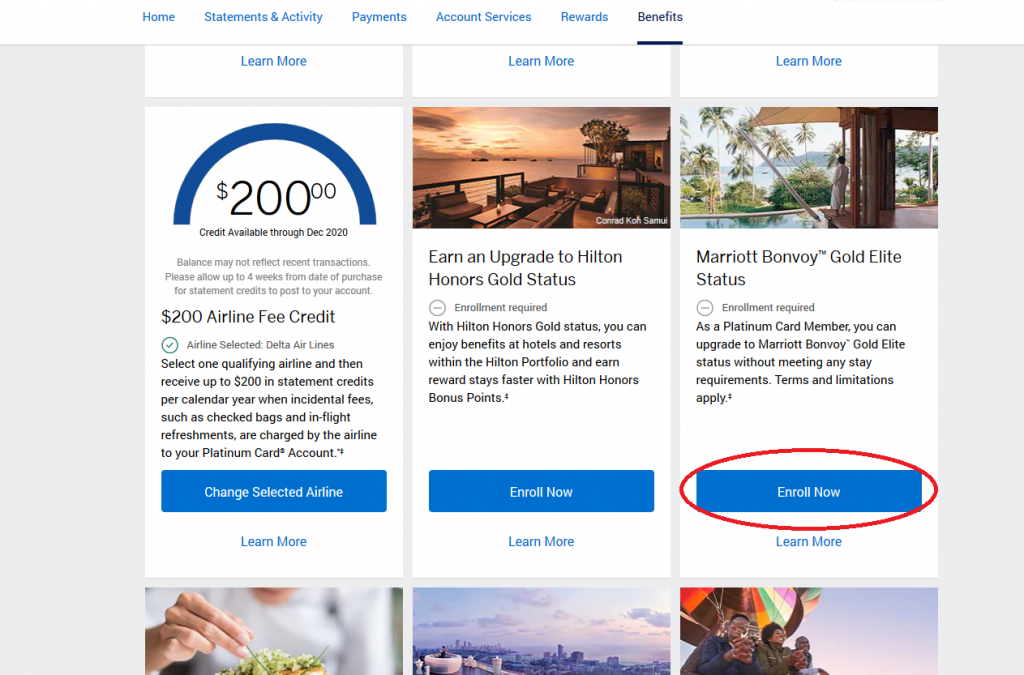

Must-Do Item #5 – Upgrade To Marriott Bonvoy Gold Elite Status

There may be times when you’ll travel to a destination that doesn’t have any Hilton properties. Should that be the case, rest easy, because the Platinum card also includes complimentary Marriott Bonvoy Gold Elite status. While not as comprehensive as Hilton Gold, you’ll be awarded benefits such as:

- 25% bonus points on each paid stay

- Room upgrades (if available)

- Late check-out

- Enhanced free WI-FI

To receive your Marriott Bonvoy Gold Elite status, you’ll first need to sign up for a free Bonvoy account here.

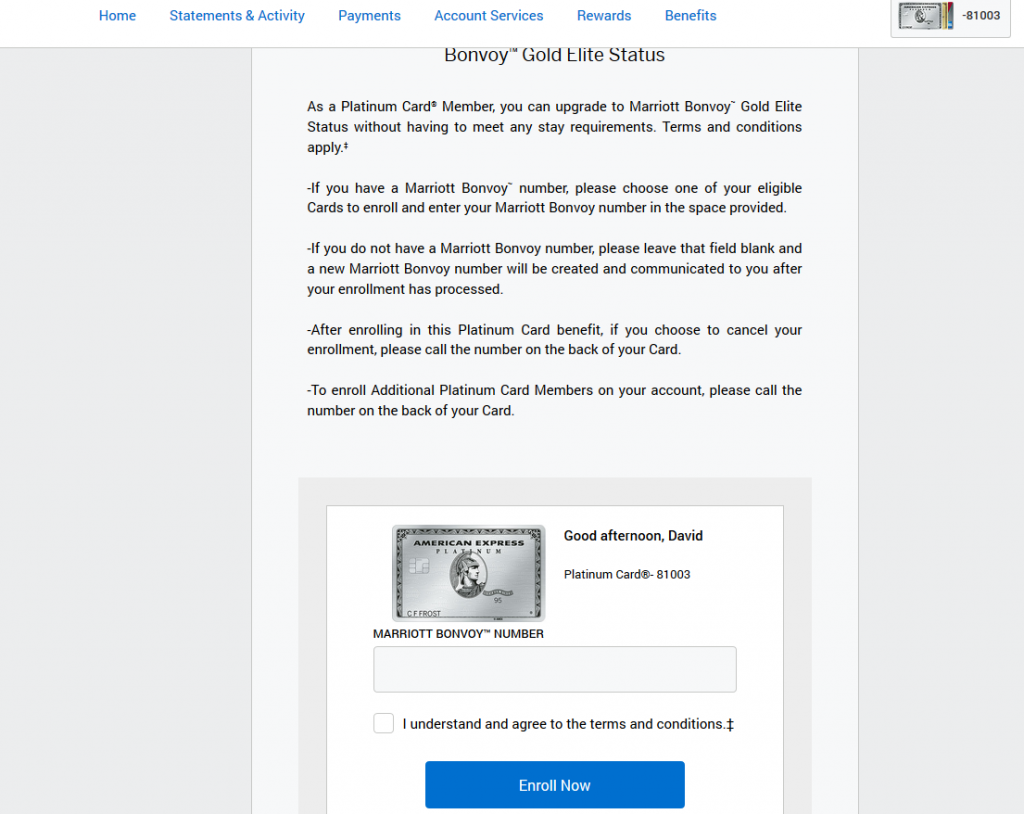

After you do that and have your Bonvoy account number, sign into your online Amex account and navigate to the benefits dashboard using the steps at the top of this article. Then, scroll down until you find the Marriott Bonvoy tile and click on the blue button labeled “Enroll now.”

After clicking that button, you’ll be redirected to a page where you’ll enter your Bonvoy account number and finalize the process by clicking “Enroll now.”

I

Must-Do Item #6 – Claim Your Free Global Entry or TSA Precheck Membership

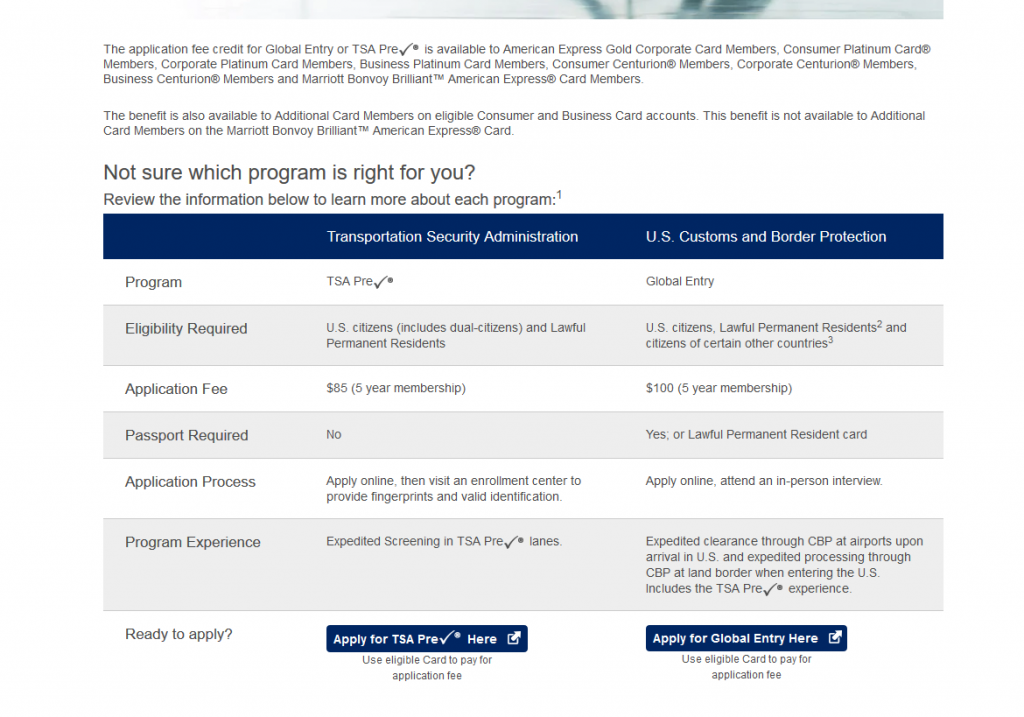

There are few things worse than standing in long lines at airports. Whether it be waiting to clear customs after a long trip or dealing with TSA security lines before boarding your plane, there are likely thousands of other things you’d rather be doing. One of the best ways to avoid these delays is to get a TSA Precheck or Global Entry membership, both of which are good for 5 years.

With your new Amex Platinum card, you’ll have the benefit getting a free membership credit to either program so your travel can be more seamless. I would recommend going with Global Entry since it includes TSA Precheck and will give you the most value.

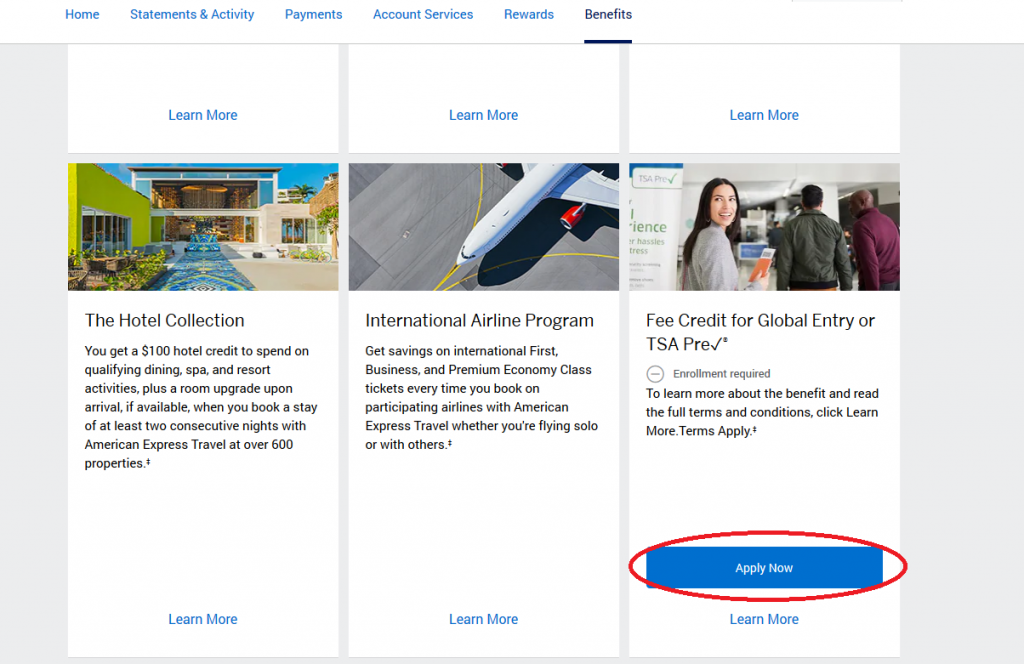

To use your free credit, you’ll need to head to the benefits dashboard of your online account and scroll down until you see the TSA Precheck/Global Entry tile and click “apply now.”

You’ll then be redirected to a page where you can see a table that compares the features of both programs. After that, just choose which program you’d like to apply for and fill in the required info on the government travel pages to complete your application.

Conclusion

The American Express Platinum card is iconic in the world of travel cards. It features a ton of unmatched features and benefits that easily can eclipse the $550 annual fee. However, not all benefits are automatic, and you’ll want to follow these 6 steps to make sure you maximize your card.